Chances are you're drowning in a sea of invoices right now, watching your team manually key in data while payments pile up and vendors start calling. Fortunately, automated invoice processing software has evolved to the point where it can handle even your messiest invoices with over 99% accuracy, turning what used to be a weeks-long nightmare into something that happens in minutes.

TLDR:

Automated invoice processing reduces costs per invoice while cutting processing time by 75%

AI-powered solutions can achieve >99% accuracy on complex documents vs ~80% with traditional OCR systems

Modern systems handle varied formats from PDFs to handwritten notes without requiring document standardization

Three-way matching automation prevents fraud while eliminating manual verification bottlenecks

Extend's system processes invoices in days rather than months with continuous accuracy improvements

What Is Invoice Processing?

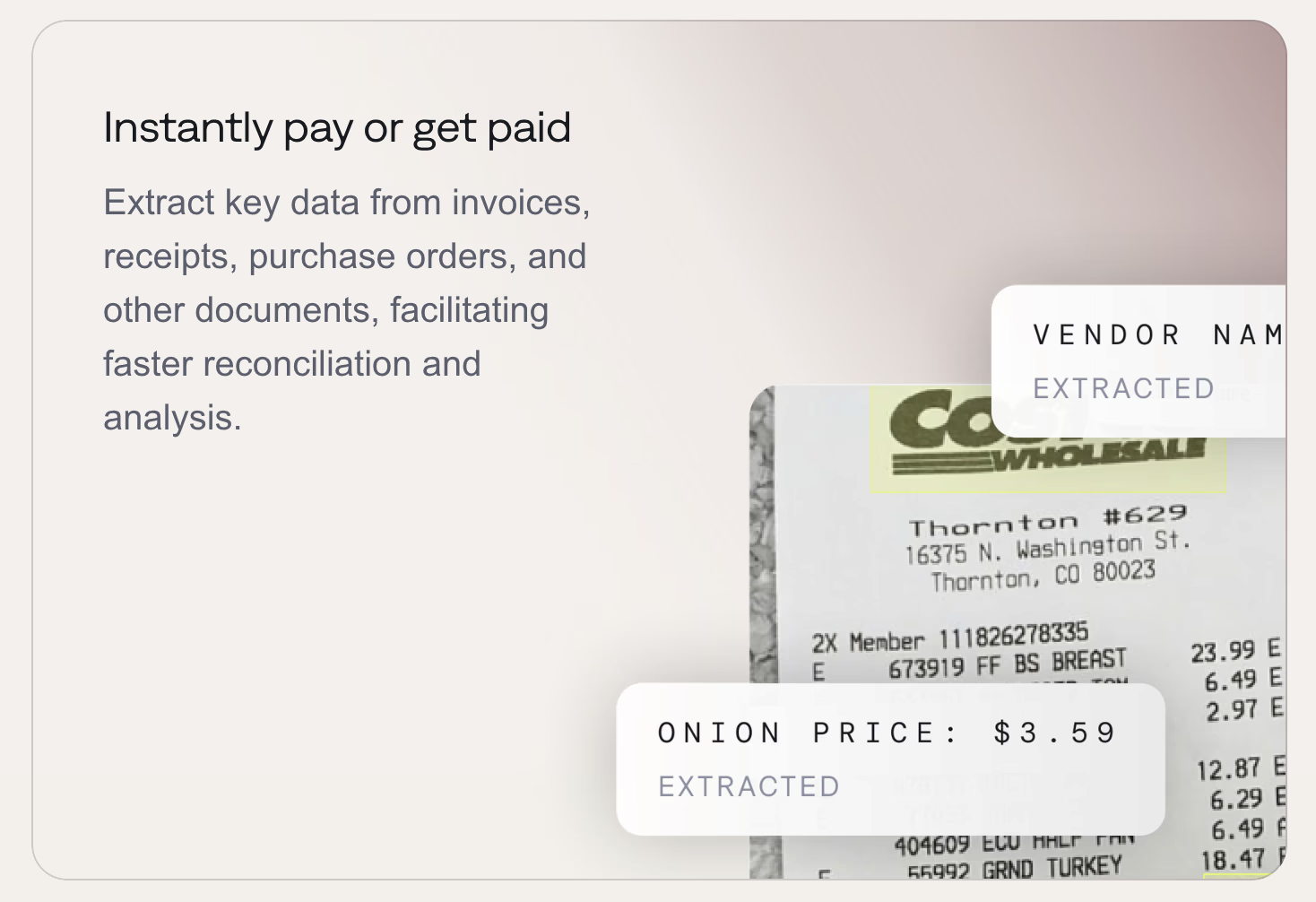

Invoice processing is the complete cycle that involves receiving an invoice from the supplier, approving it, creating the remittance data, paying the bills, and recording the successful payment in the ledger. This complete workflow forms the backbone of accounts payable operations and directly impacts cash flow management.

The process extends far beyond simple data entry. It includes document validation, three-way matching against purchase orders and receipts, approval routing based on company hierarchies, and compliance verification. Each step requires careful attention to detail because errors can cascade through the entire financial system.

Modern invoice processing must handle diverse document formats, from structured PDFs to photos of paper invoices, while maintaining accuracy across different layouts and languages.

Traditional approaches often struggle with the variety of invoice formats businesses receive daily. Suppliers use different templates, some invoices arrive as scanned images with poor quality, and others contain handwritten notes or corrections that complicate extraction.

That's where advanced document intelligence becomes important. Extend's AI-powered processing solutions can parse complex layouts, interpret tables with merged cells, and extract data from degraded scans while maintaining exceptional accuracy rates.

Manual Invoice Processing Steps

Manual invoice processing follows a predictable but labor-intensive sequence that creates multiple opportunities for errors and delays. The process typically begins when invoices arrive via email, mail, or supplier portals in different formats.

First, someone must collect and sort incoming invoices, often from multiple channels. This initial step already introduces delays as invoices might sit in email inboxes or physical mailboxes before processing begins.

Next comes data entry, where staff manually input invoice details into the accounting system. This includes vendor information, invoice numbers, line items, tax amounts, and payment terms. Research shows that 61% of late invoice payments in the U.S. are caused by simple invoicing errors that occur during this manual transcription phase.

The verification step requires matching invoices against purchase orders and delivery receipts. Staff must locate the corresponding documents, compare line items, and flag discrepancies. This three-way matching process is critical for preventing fraud but becomes time-consuming when done manually.

Approval routing adds another layer of complexity. Invoices must travel through the appropriate approval chain based on amount thresholds and department budgets. Physical documents get passed between offices, while digital versions wait in email queues.

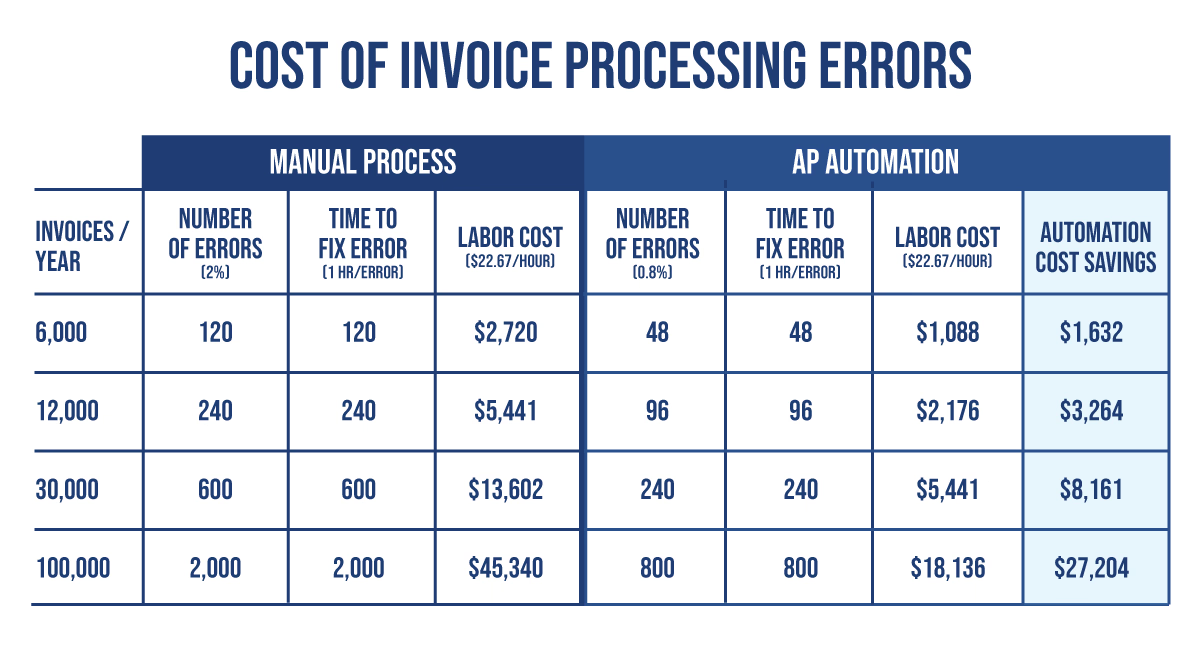

The financial impact is substantial. Companies with low process maturity spend $6.20 per invoice compared to $1.83 per invoice for those with high process maturity. The cost difference reflects labor expenses and the hidden costs of errors, delays, and missed opportunities. This adds up quickly for companies processing invoices regularly.

Supply chain operations face particular challenges with freight invoices that contain complex rate calculations and accessorial charges. Healthcare organizations deal with invoices that reference specific patient cases or insurance requirements, adding regulatory compliance complexity.

Benefits of Automated Invoice Processing in 2025

The business case for invoice automation has never been stronger, with 2025 market data showing compelling returns on investment across multiple dimensions. Invoice automation greatly reduces processing costs, cuts processing time by up to 75%, and minimizes errors by up to 90%.

Cost reduction is the most immediate benefit. Automated systems eliminate the labor costs associated with manual data entry, document routing, and exception handling. The savings compound over time as processing volumes increase without proportional staff increases.

Accuracy improvements deliver both direct and indirect value. Direct benefits include fewer payment errors, reduced duplicate payments, and elimination of data entry mistakes. Indirect benefits include improved vendor relationships, better cash flow forecasting, and enhanced financial reporting accuracy.

Real-world results back this up: Nuvocargo publicly shared how they reached 99% accuracy with AI-powered document processing across borders, virtually eliminating manual review for complex workflows and proving that these systems can perform at scale.

Processing speed acceleration lets businesses capture early payment discounts and improve working capital management. Invoices that previously took weeks to process can be handled in days or hours, depending on approval requirements and document complexity.

Compliance improvement becomes more important as regulatory requirements change. Automated systems maintain complete audit trails, enforce approval hierarchies, and guarantee consistent application of business rules across all transactions.

Companies using advanced AI-powered invoice processing achieve >95% field-level accuracy on complex documents while reducing manual exceptions by 90%.

Scalability benefits allow businesses to handle volume fluctuations without staffing adjustments. Seasonal businesses, growing companies, and organizations with variable invoice volumes benefit from systems that automatically scale processing capacity.

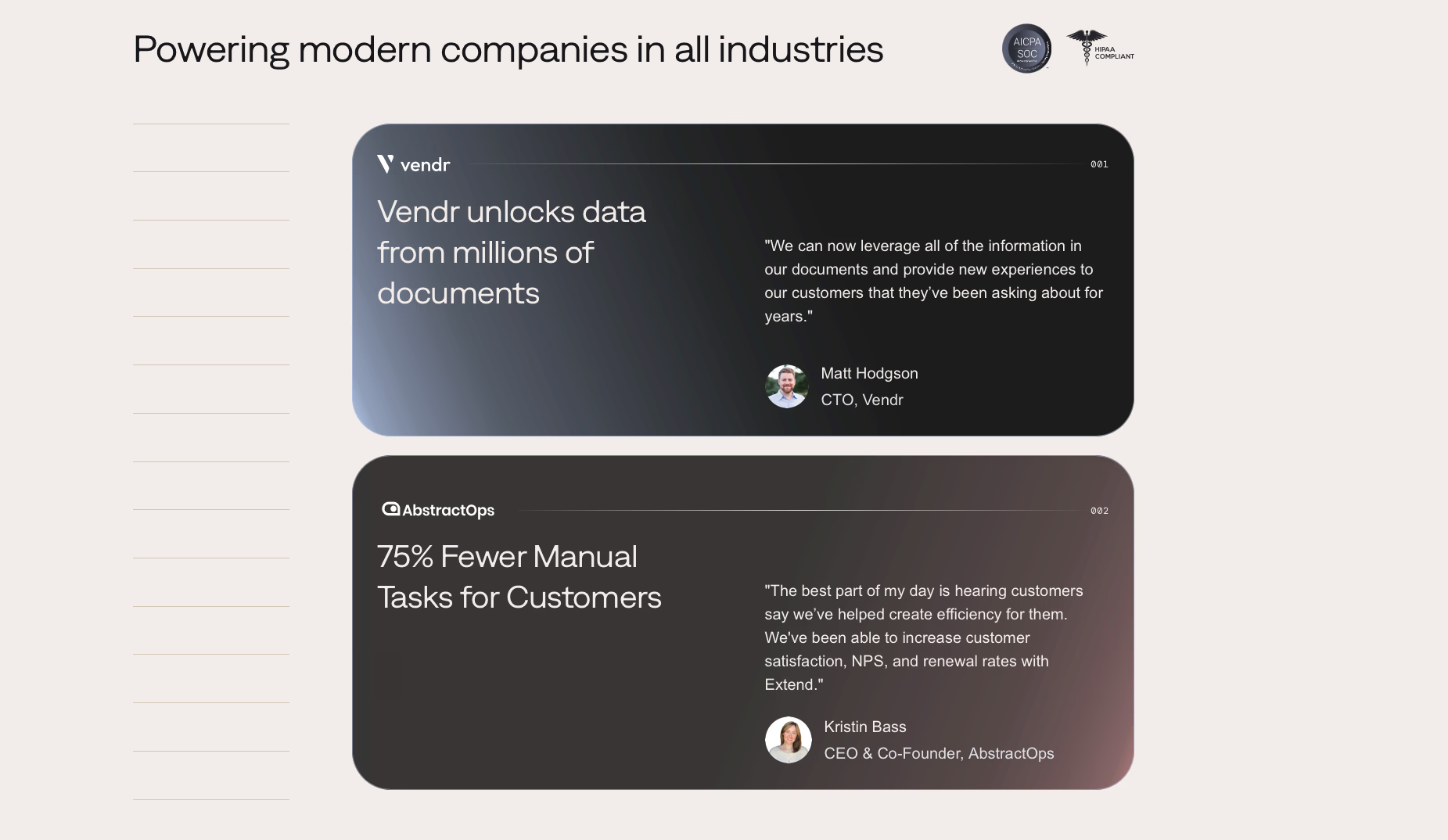

HomeLight achieved 99% accuracy while eliminating manual review requirements. AbstractOps also improved their document processing power with Extend.

Invoice Processing Software Solutions

The 2025 market offers diverse invoice processing solutions ranging from basic invoicing tools to full AP automation systems. Understanding the differences helps businesses select appropriate solutions for their specific needs and complexity levels.

Basic invoicing software focuses primarily on invoice creation and simple payment tracking. Tools like QuickBooks and FreshBooks serve small businesses with straightforward requirements but lack advanced processing features for complex documents or high volumes.

Mid-market solutions like Bill.com and AvidXchange provide more sophisticated workflow management, approval routing, and integration features. These systems handle moderate complexity but may struggle with non-standard document formats or industry-specific requirements.

Enterprise-grade solutions offer full functionality including advanced OCR, machine learning features, and extensive integration options. However, many require substantial implementation time and may not achieve the accuracy levels needed for mission-critical workflows.

AI-powered document intelligence represents the newest category, focusing on extracting accurate data from complex documents. Unlike traditional OCR solutions that struggle with varied layouts and poor image quality, these systems use LLMs and VLMs to understand document context and structure.

The key differentiator lies in accuracy and flexibility. Traditional solutions often require businesses to standardize their document formats or accept lower accuracy rates. Modern AI-based systems adapt to existing document varieties while maintaining >99% accuracy across different formats.

Configuration and evaluation tools allow businesses to fine-tune processing for their document types. The splitter processor feature handles complex multi-document files that arrive as single submissions.

Why Extend?

Extend is the complete document processing toolkit. Our platform gives you the most accurate parsing, extraction, and splitting APIs to ship your hardest use cases in minutes, not months. Use our suite of models, infrastructure, and tooling to give you the most powerful custom document solution, without any of the overhead. Our agents automate the entire lifecycle of document processing, allowing your engineering teams to process your most complex documents and optimize performance at scale.

We take invoice automation further than traditional AP tools by combining AI-powered document intelligence with flexible workflows designed for real-world complexity. Unlike legacy OCR solutions that top out at ~80% accuracy, Extend consistently achieves >99% field-level accuracy, even on degraded scans, handwritten notes, and multi-page utility bills.

Key advantages of Extend:

- Faster Processing: Invoices that once took weeks now move from receipt to payment in days.

- Continuous Improvement: Accuracy and speed increase the more you use it, thanks to adaptive AI models.

- Proven Results: Companies like HomeLight and AbstractOps have hit 99% accuracy while eliminating manual reviews.

FAQ

How long does it take to implement automated invoice processing?

Most businesses can deploy AI-powered invoice processing solutions in days rather than months, with some achieving production-grade accuracy within hours of setup. Traditional enterprise solutions often require 3-6 months for full implementation.

What accuracy rates can I expect from modern invoice processing systems?

Advanced AI-powered systems consistently achieve over 99% field-level accuracy on complex documents, compared to 80% typical with legacy OCR solutions. This higher accuracy greatly reduces manual exceptions and review requirements.

Can automated systems handle handwritten invoices and poor-quality scans?

Yes, modern LLM-powered document processing can interpret handwritten notes, degraded scans, and complex layouts that traditional OCR systems struggle with. These systems use context understanding rather than just character recognition to extract accurate data.

When should I consider upgrading from my current manual process?

If your team spends more than 15-30 minutes per invoice on data entry and verification, or if you're experiencing error rates above 3-5%, automation will deliver immediate ROI. Companies processing over 100 invoices weekly typically see substantial cost savings.

Final thoughts on Invoice Processing Automation

Manual invoice processing doesn't have to drain your resources while errors pile up and vendors wait for payment. The technology has evolved to handle your messiest documents with remarkable accuracy, turning weeks of work into automated workflows that run in the background. Extend's document processing platform can change how your team handles invoices, freeing them up for strategic work instead of data entry.

Your business deserves systems that scale with growth rather than create bottlenecks.